For a comprehensive overview of financial and technical risks associated with PPAs, see A Local Government’s Guide to Off-Site Renewable PPA Risk Mitigation.

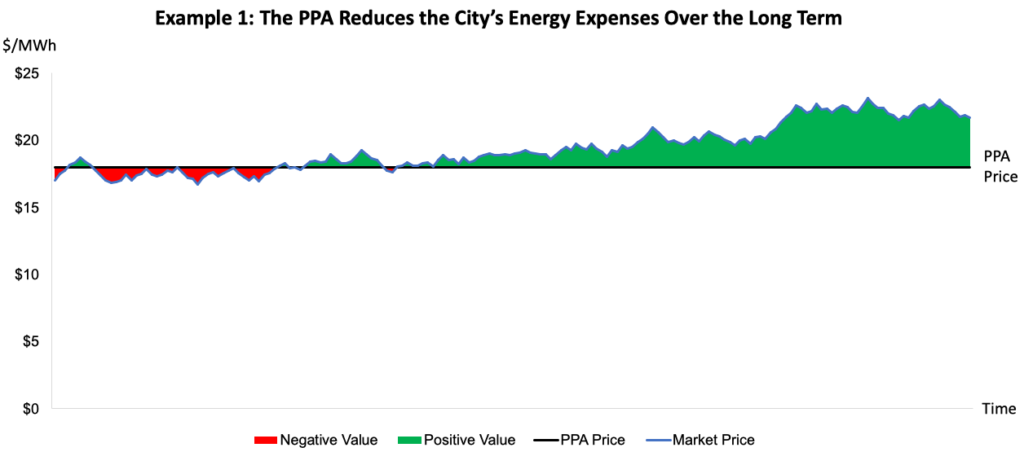

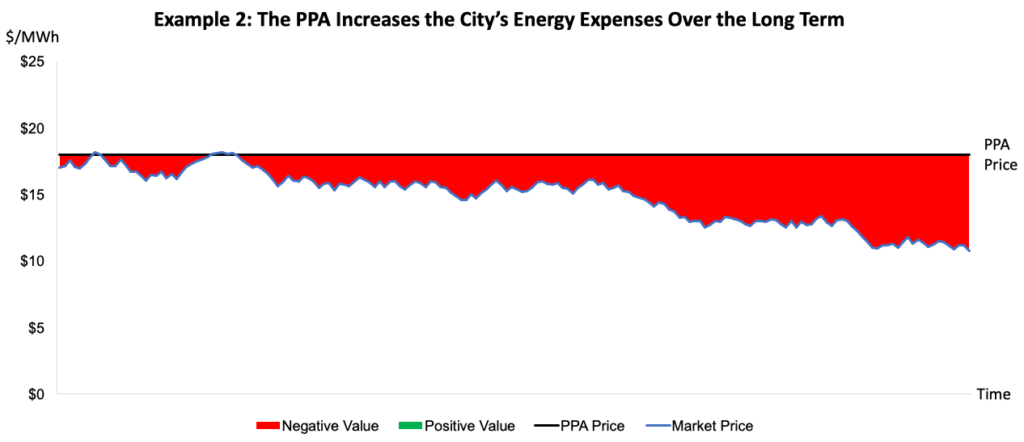

VPPA price risk arises from the fact that the energy is being sold into an open market where energy market prices vary over time. These fluctuations create financial uncertainty, or risk, regarding the revenue that will be generated by selling the project’s electricity into the market (i.e., the buyer’s revenues). This risk has two important implications for cities to consider: