For a comprehensive overview of financial and technical risks associated with PPAs, see A Local Government’s Guide to Off-Site Renewable PPA Risk Mitigation.

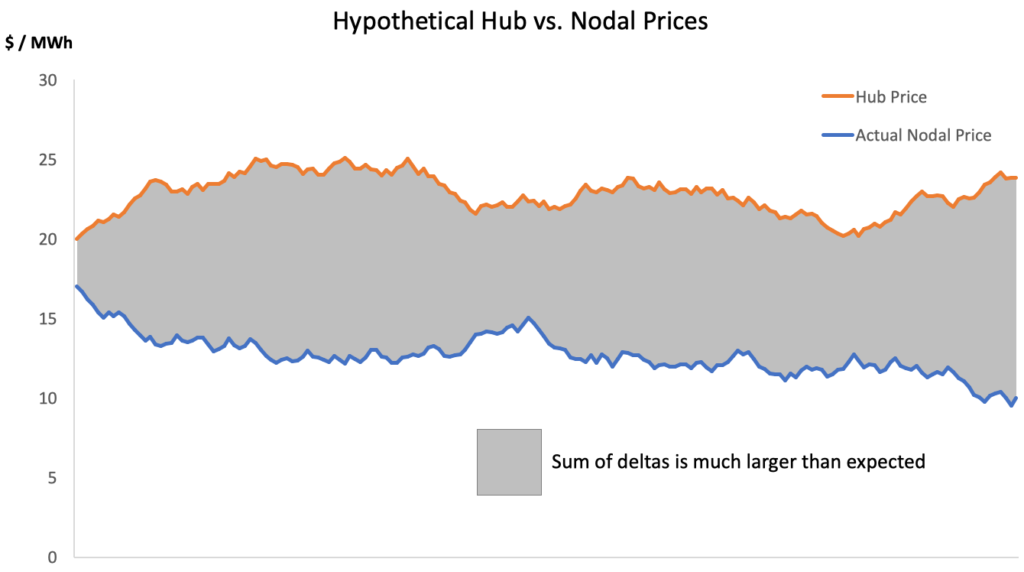

To understand basis risk, it is useful to first review some important aspects of US energy markets.