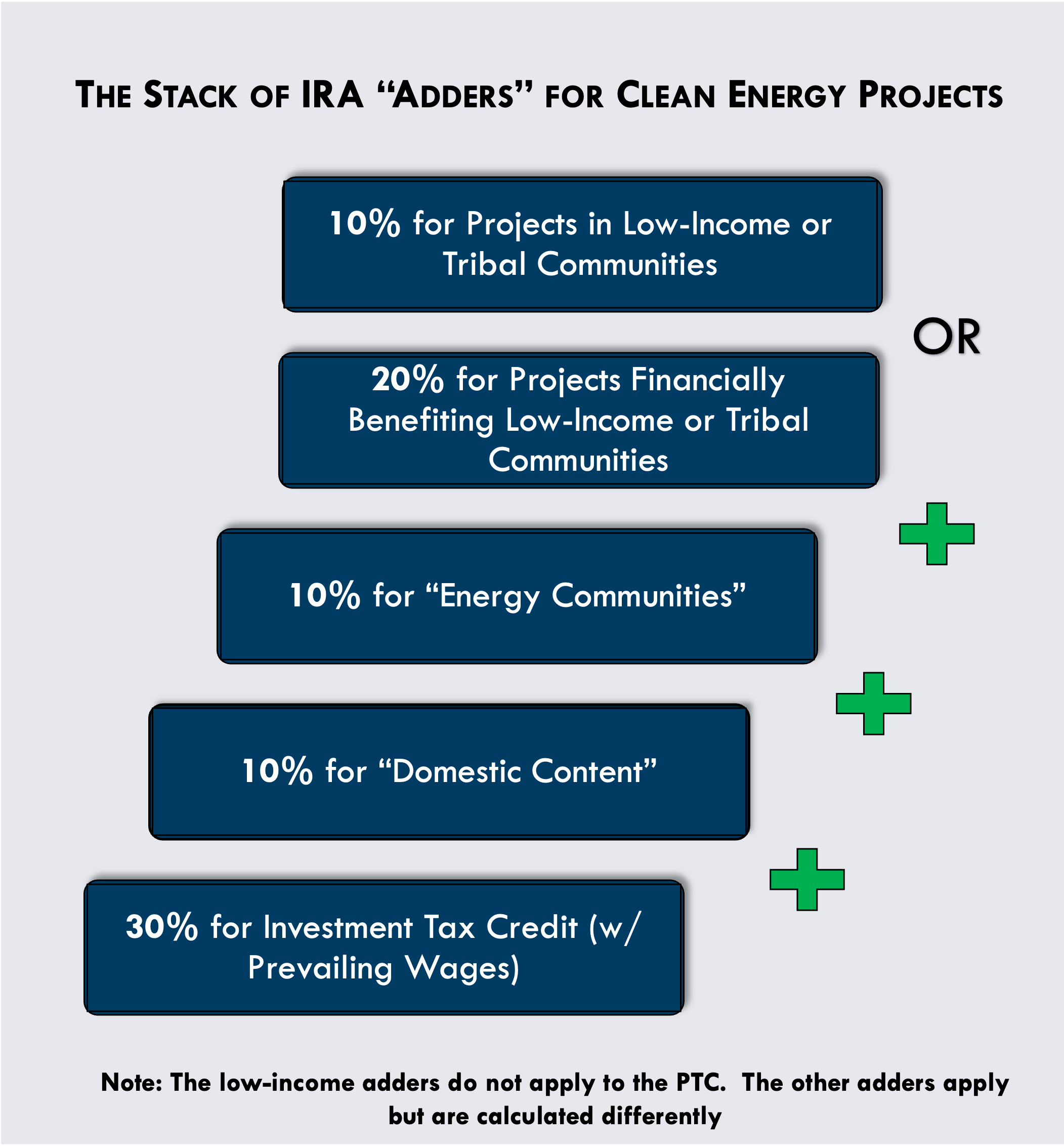

The Inflation Reduction Act created new ”adders” that incentivize projects that specifically advance elements of an equitable clean energy transition, including where projects are located, who benefits from them, and where materials are sourced. Your city may have multiple reasons for buying renewable energy as a part of your local energy transition. Accordingly, you should evaluate the following four adders that build on the ITC and PTC. You should determine if one or more align with your city’s goals and design projects that can leverage these additional project incentives. Note that the two Low Income Community adders do not apply to the PTC.

In addition to the below definitions of the adders, you can use this mapping tool to identify geographically-bound incentives.