A power purchase agreement (PPA) is a contract with the developer of an energy project in which a buyer agrees to purchase the energy produced by the project over a set period of time at a predetermined price per unit of energy, such as a megawatt-hour (MWh).

A power purchase agreement (PPA) is a contract with the developer of an energy project in which a buyer agrees to purchase the energy produced by the project over a set period of time at a predetermined price per unit of energy, such as a megawatt-hour (MWh).

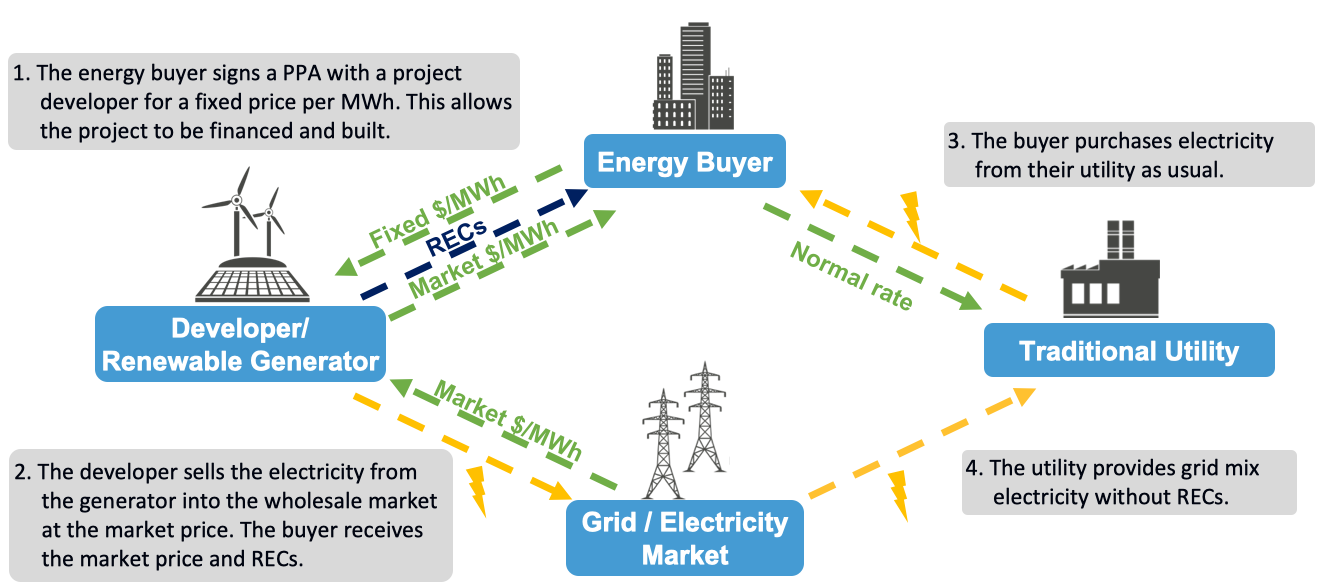

A virtual PPA (VPPA), is a financial arrangement between a developer and the buyer which guarantees a cash flow for the renewable energy project based on output. The electricity generated from the project is sold into the local wholesale electricity market; the revenue from this sale, which varies depending on local electricity prices, is then returned to the buyer. This is unlike a physical PPA, in which the buyer takes ownership of the produced energy.

Because of the structure of a VPPA, such deals are also known as “contracts for differences,” or “fixed-for-floating swaps,” since the buyer is effectively paying a fixed $/MWh rate and receiving a floating market $/MWh rate in return. The buyer in a VPPA typically also receives the renewable energy certificates (RECs) associated with the project’s renewable energy.

See the diagram above for an overview of how VPPA contracts work. For more information, visit the EPA overview or review the overview prepared by RMI.