There are two primary contractual structures used in aggregated transactions: off-site physical PPAs and virtual PPAs.

The video below provides an overview of the off-site procurement options available to aggregation groups.

There are two primary contractual structures used in aggregated transactions: off-site physical PPAs and virtual PPAs.

The video below provides an overview of the off-site procurement options available to aggregation groups.

With a physical PPA, buyers purchase electricity from a utility-scale, off-site renewable energy generator to use at their facilities. Physical PPAs are sometimes referred to as “sleeved PPAs” because a utility or third party delivers, or “sleeves,” the power from the project site to the buyer. See Exhibit 2 for an overview of how an aggregated physical PPA contract works.

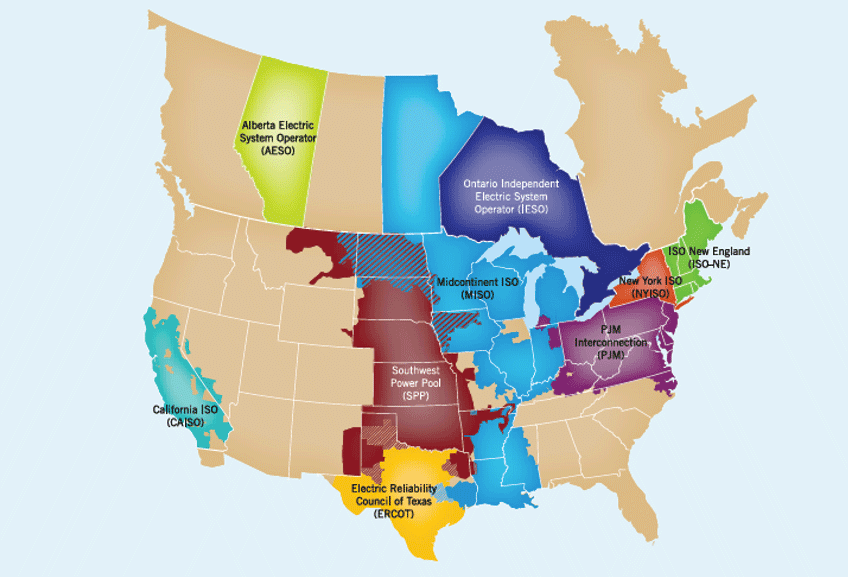

For aggregated groups that want to receive energy from an off-site physical PPA, the renewable resource needs to be located in, or have access to, the same wholesale market as the buyers.

Buyers should also be relatively close together (e.g., within the same distribution utility area) to avoid issues related to transmission costs or other constraints that may cause the price of energy from any given project to differ significantly across buyers.

Depending on state regulations, buyers have three options to receive the energy from a PPA.

While buyers in an aggregated deal do not necessarily need to pursue the same delivery option, it is generally easiest and more cost-effective to do so.

1. Working with a Traditional Utility:

A traditional utility may agree to deliver, or “sleeve,” the energy from the physical PPA to the buyer, usually in exchange for a fee ($/kWh) incorporated into buyers’ electricity bills.

The video below explains how to sign a utility special contract and provides real-world examples.

2. Working with a Competitive Retail Supplier:

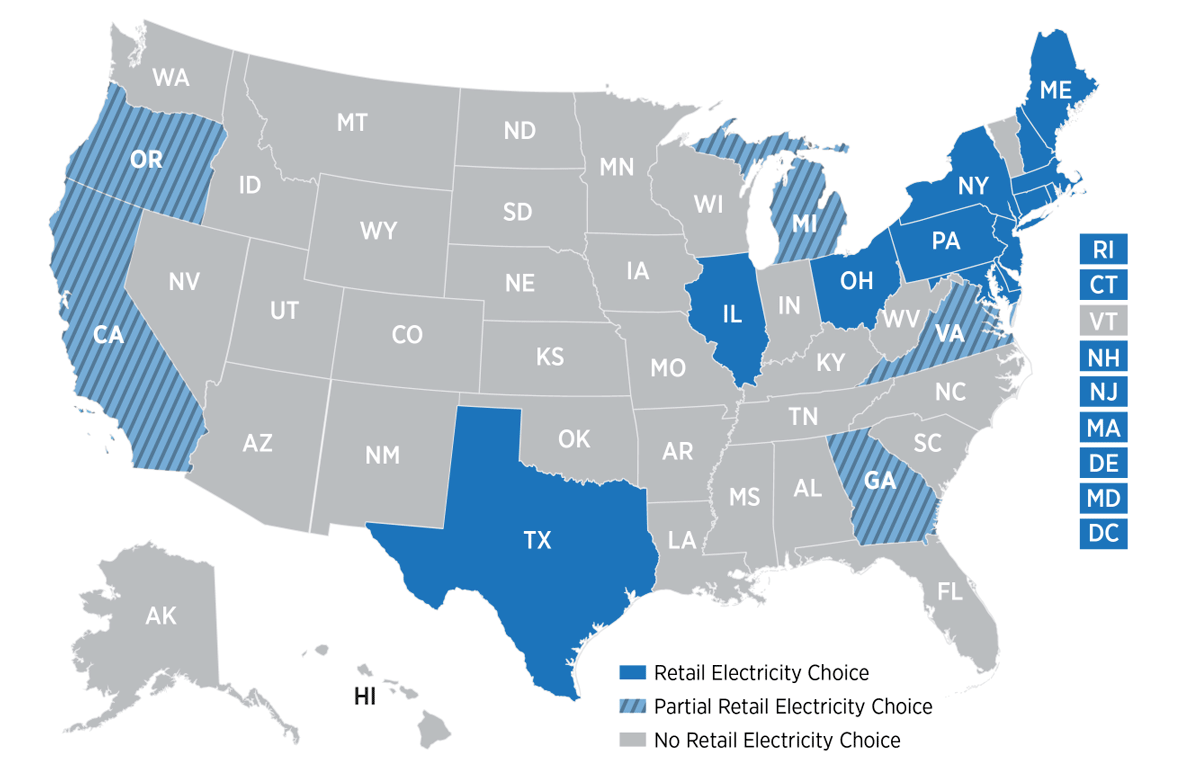

Buyers in states with retail choice can sign a contract with a retail supplier to integrate the energy from a project into their electricity service.

3. Managing One’s Own Power:

Buyers can also integrate a physical PPA into wholesale market operations via a wholesale market subaccount or as a Federal Energy Regulatory Commission (FERC) licensed power marketer.

Managing power via a wholesale market subaccount:

Subaccounts provide a mechanism through which buyers can access competitive market prices and actively manage their energy purchases via an established power marketer/retailer. This approach makes the most sense for local governments that already have a subaccount or for those that have a large load and would be interested in purchasing electricity on the wholesale market.

Managing power as a FERC-licensed power marketer:

Instead of working with a retailer, buyers may be able to directly manage their own power as a power marketer. Becoming a power marketer requires completing a lengthy application process with the FERC. As such, this approach makes the most sense for local governments that are already managing power as a FERC licensed power marketer (e.g., cities with their own municipal utility).

Baltimore Metropolitan Council, Off-Site Solar RFP and Cincinnati, Ohio, Off-Site Physical PPA

For more information on off-site physical PPAs, visit Procurement Guidance for Off-site Physical PPAs

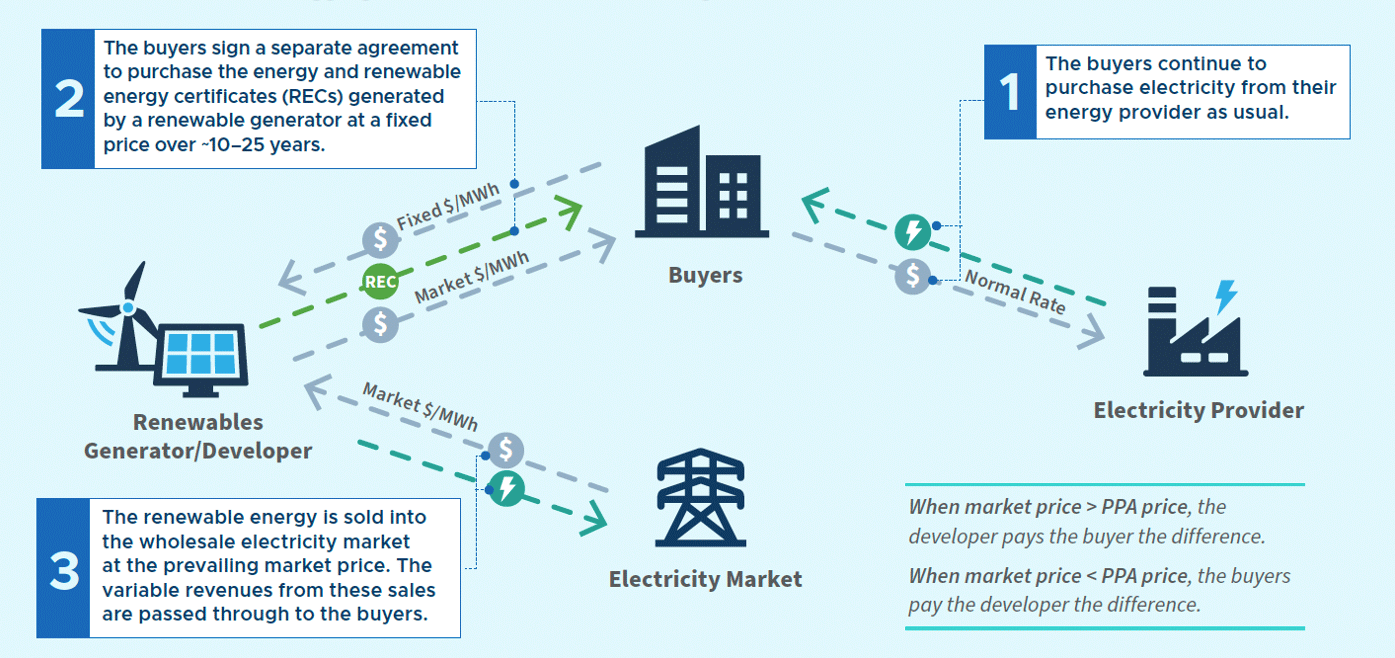

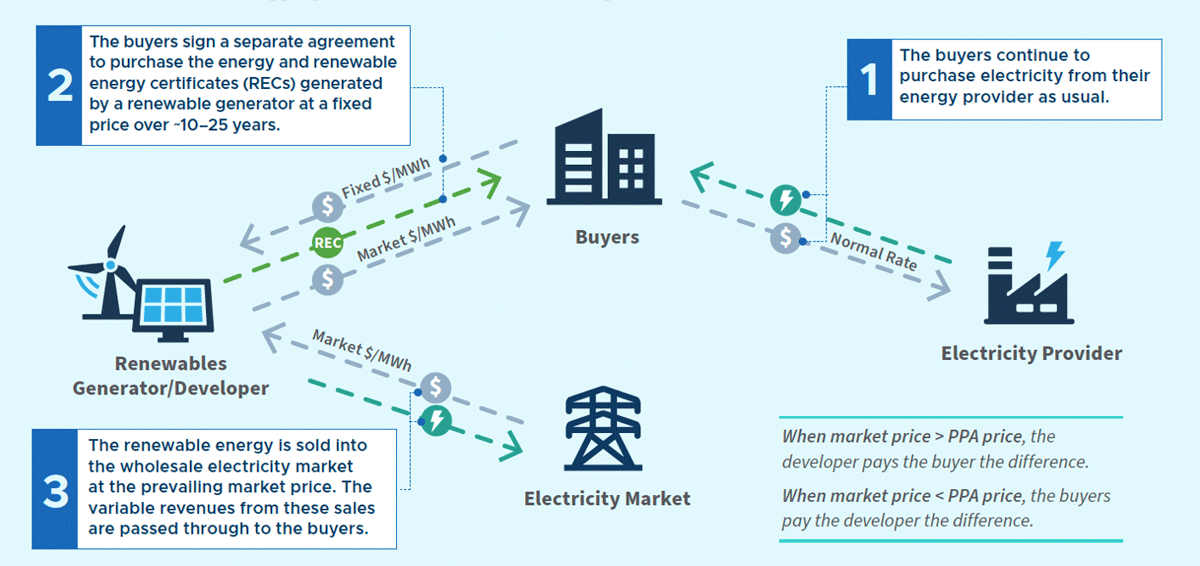

A virtual PPA (VPPA) is a financial arrangement between a renewable energy project developer and a group of buyers. Unlike a physical PPA, the buyer does not take ownership of or receive the produced energy, and there is no direct impact on a buyer’s physical operations or utility bills. Instead, the electricity generated by the project is sold into a wholesale electricity market at the prevailing price (which can fluctuate significantly over time, depending on market conditions). If the wholesale market prices are greater than the predetermined $/MWh PPA price, the developer pays the positive difference to the buyers. If the wholesale market prices are lower than the PPA price, the buyers pay the difference to the developer. The buyers also, typically, receive the associated RECs. See Exhibit 4 for an overview of how an aggregated virtual PPA contract works.

There are many benefits of virtual PPAs that make them attractive to buyers: