For a comprehensive overview of financial and technical risks associated with PPAs, see A Local Government’s Guide to Off-Site Renewable PPA Risk Mitigation.

Physical power purchase agreements (PPAs) allow cities to stabilize their energy costs by fixing their electricity rate for 10–25 years. As a result, a PPA, by definition, reduces a city’s financial uncertainty (i.e., risk). That being said, cities that sign a PPA face a different type of uncertainty, namely whether signing a PPA will ultimately increase or decrease their energy expenses as compared to what they would have paid otherwise. This is known as “price risk.”

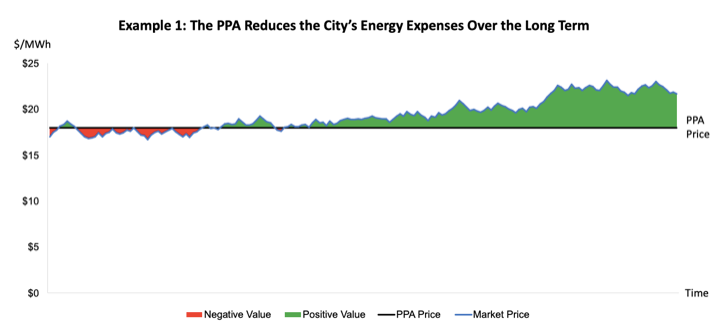

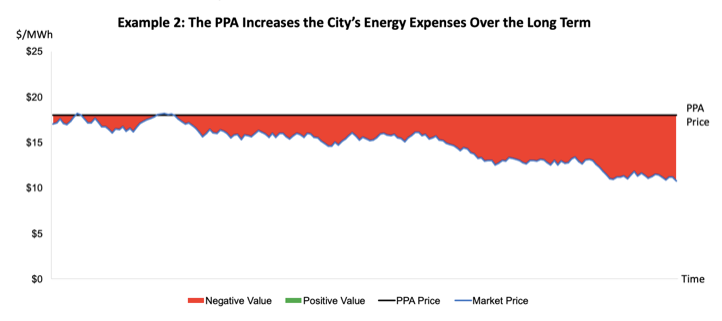

To illustrate this uncertainty, imagine that a city is choosing between signing a fixed-price PPA or purchasing electricity from the wholesale market. As illustrated in Example 1 below, if wholesale electricity market prices (shown in $/MWh) were to rise above the PPA price, signing the PPA would have resulted in significant savings for the city. However, if wholesale market prices were to remain below the PPA price, the city would have been financially better off simply buying electricity from the market. We will explore strategies to evaluate this risk in the “Develop a Business-as-Usual Forecast” section.